News

Hydrogen instead of diesel

Lorries are becoming a more common sight on our roads. Stricter environmental regulations and rising fuel prices necessitate a rethinking of how we design engines. What role can hydrogen play as an energy source?

The transportation sector is booming worldwide. In Germany the quantity of transported goods in 2018 was 3.75 billion tons. In spite of the pandemic and military conflicts, predictions expect an increase in goods transportation in the medium term. These growing numbers also lead to greater traffic, more noise, increased fuel consumption, and higher carbon monoxide emissions: Road traffic with heavy and light vehicles, including buses, issued around one third of traffic emissions in 2019, with 58.3 million tons of CO2. In order to reduce the CO2 emissions of commercial vehicles, EU regulations aim to reduce the average emission output of newly authorised vehicles by 15 per cent by 2025, and by 30 per cent by 2030. This is a considerable challenge. This is coupled with the rising prices for fuel, which poses significant problems for the logistics industry.

Electric battery engines are not a cure-all

In the logistics industry, too, electric cars are becoming more common. However, these vehicles also come with their own obstacles. They are worthwile for smaller lorries with up to 2.8 tons of payload, but it is extremely challenging to use them in heavy and long-distance traffic, as well as for construction vehicles or street sweepers. The added weight for batteries and the costs are major hurdles for their use. Then there is the sometimes insufficient ranges, long charging times, and lack of a charging infrastructure. However, improvements are urgently required in the heavy-load area, as these vehicles in particular have the greatest CO2 output, meaning the need for a change in this regard is dire. This is why it is necessary to expand the charging infrastructure as much as possible and to examine other technologies as well, such as hydrogen.

In Europe alone, there are expected to be around 100,000 hydrogen vehicles on the road by 2030, plus 1500 hydrogen fuelling stations. 62 companies have come together to achieve this, including lorry manufacturers, suppliers, energy providers, and logistics companies.

How hydrogen engines work

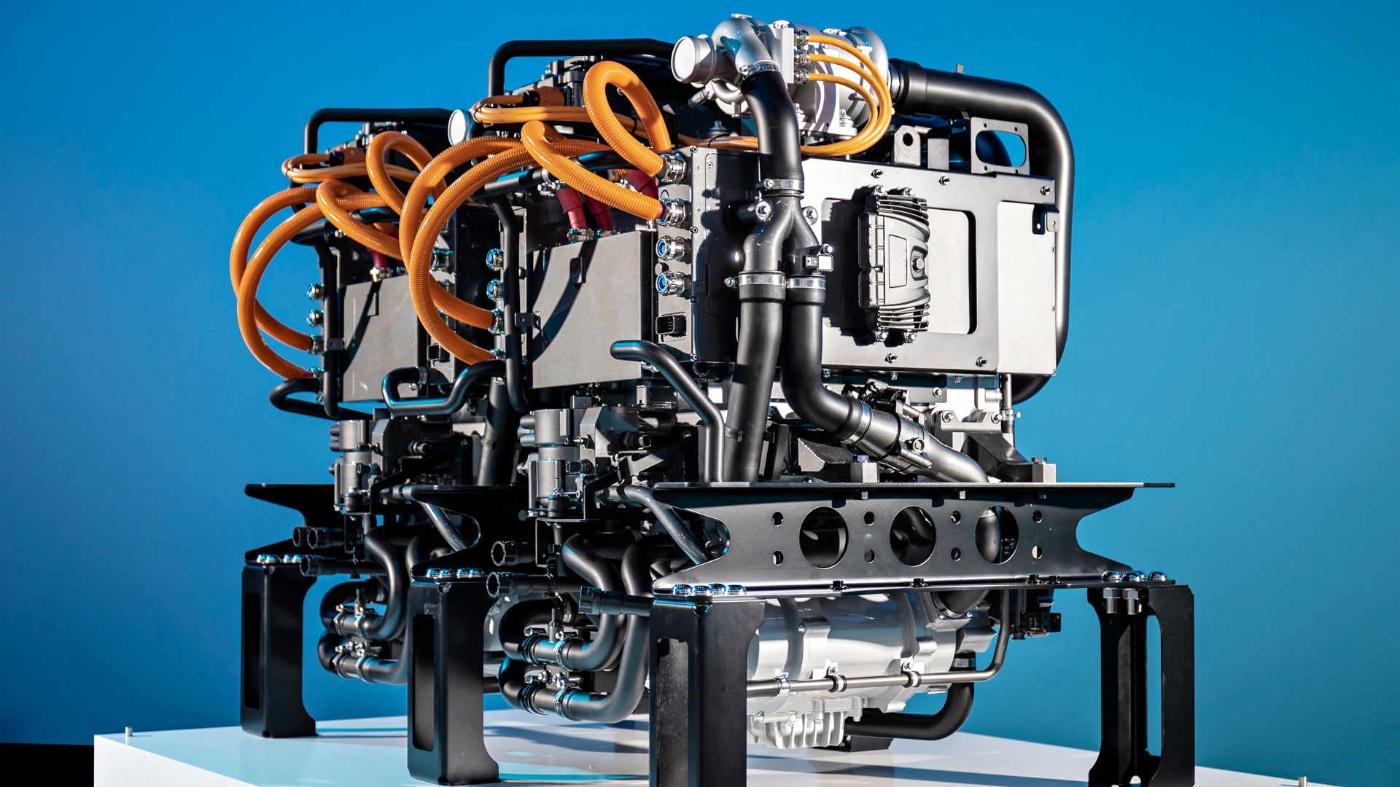

Colourless, odourless, flammable, most common element in the universe, with the lowest density of all elements, relatively simple to make from common water, and especially easy to store and transport: hydrogen. For fuel cells it is kept in a tank in the vehicle, converted into power via reaction with oxygen in a fuel cell, thereby propelling the electric motors. Steam is the exhaust.

The advantage of this technology is that large tanks facilitate long ranges with one filling. Filling up is similar to the usual process, which is important in an industry where time is money. The effectiveness is also quite high at around 60 per cent (combustion engine: 30 per cent) – and there are no emissions. Disadvantage: Fuel cells do have a long service life (approx. 10,000 operating hours), but they are highly complex and still quite expensive.

Hydrogen can be used as fuel in another way, too: Manufacturers and suppliers are working on a solution in which hydrogen can fuel a combustion engine. Available structures could be used, and costs could be saved on development and storage. The advantages: Combustion engines can be retrofitted, such as by IAA Transportation exhibitor Clean Logistics, and can work even with lower-quality hydrogen. However, the efficiency is not as great as fuel cells; burning lubricants also generate minor emissions. However, post-treatment of exhaust could completely filter these emissions out.

These manufacturers are currently working on hydrogen as a fuel

Established manufacturers and newcomers are in a race to determine who will bring the most efficient, advanced, wide-coverage vehicle to the market. This is all flanked by many national funding programmes that promote climate-friendly vehicles. For example, Germany's Federal Ministry for Digital and Transport earmarked a total of 1.6 billion euros to fund the acquisition of climate-friendly commercial vehicles by 2024, and about 5 billion euros to establish the filling and charging infrastructure.

- Daimler Truck and Volvo are working together to develop a fuel cell system for lorries, the serial production of which is planned to begin in the second half of the decade. Renault is also involved.

- Daimler Truck itself has the heavy-load lorry prototype GenH2 with two fuel cells, two e-machines, and two stainless steel tanks for 80 kg of liquid hydrogen, stored at -253° Celsius. The energy density is greater and space requirements are lower, but the liquification of the hydrogen consumes a lot of energy. The trucks gained road approval in October 2021, are currently undergoing intensive testing, and are expected to enter serial production as of 2025. The technology allows for journeys of up to 1000 kilometres.

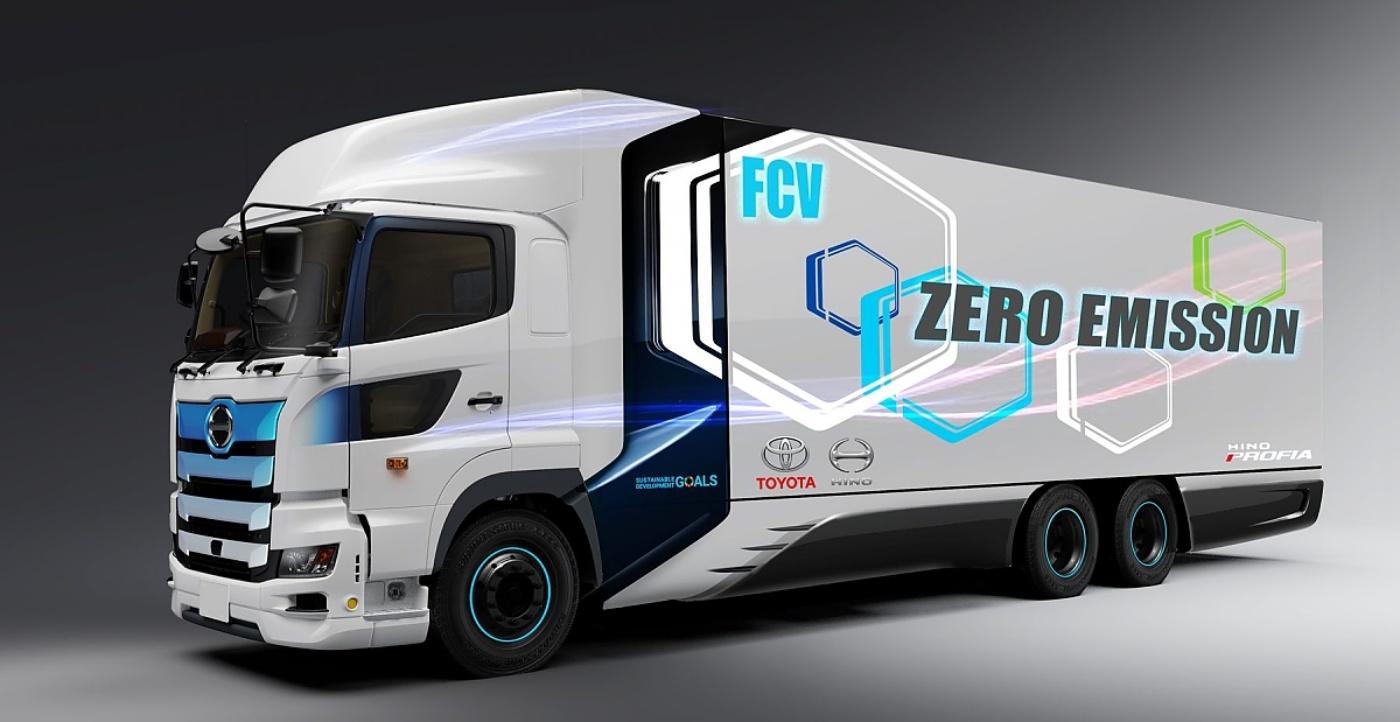

- MAN develops hydrogen combustion engines as well as fuel cell engines. MAN's parent corporation Traton is also working with Japanese lorry manufacturer Hino, a subsidiary of Toyota, on fuel cell engines.

- FAUN is one of the first suppliers worldwide to offer hydrogen-powered trucks in series production. Based on the Econic chassis from Daimler Trucks, the vehicle manufacturer specializing in municipal vehicles has the three-axle "BLUEPOWER" in its range as a carrier vehicle for refuse collection or sweeper superstructures. Based on the two-axle Atego, the flexible "CITYPOWER" for transporting goods is to be launched in 2023.

- As of this year, Toyota and Hino want to conduct practical tests on fuel cell lorries with a total weight of 25 tons. In China, Toyota is working with five Chinese companies in the "United Fuel Cell Systems R&D" to develop fuel cell lorries.

- US company Nikola and Iveco from Italy will produce the model Nikola Tre in Ulm. The truck will be designed as an electric battery-powered version, and, as of 2023, as a version with a fuel cell engine and hydrogen pressure tank. Bosch supplies fuel cells and central computers, among other items.

- According to Hyundai, it is serially producing the first heavy lorry with an electric fuel cell engine – the Xcient Fuel Cell. The first units are being used for transport in Switzerland, among other places, as well as for the chain stores Coop and Migros. Hyundai wants to use 1600 of these hydrogen lorries there by 2025.

- US company Hyzon Motors founded its European headquarters last summer in Groningen, where its first fuel cell lorries will be created based on a tractor trailer from the manufacturer DAF.

First customers relying on hydrogen

Multiple companies in Germany are already planning to employ hydrogen lorries in their heavy-load logistics, including retail chain Edeka and fresh goods service provider Meyer Logistik. There are also many considerations in the area of short-distance transport to equip buses with fuel cells, such as in the Black Forest.

Basic requirement: green hydrogen

However, in order for hydrogen engines to be climate neutral (either with a fuel cell or a hydrogen motor), it comes down to acquiring the fuel itself: The most commonly used grey hydrogen is primarily acquired from natural gas. Energy is used to break water down into its individual components. However, the use of natural gas releases CO2.

From an environmental perspective, hydrogen engines are only sensible if the fuel comes from a renewable resource. Experts refer to this as green hydrogen, wherein water is divided into hydrogen and oxygen via green energy. Of course, energy is lost during the conversion process, but water and steam are the only by-products. Green hydrogen is not yet renewable, however. Demand could increase in air travel and metal processing, which use much more CO2. Green energy must thus be stored and imported from abroad – the first of these projects can already be seen in Australia, for example.

Hydrogen – more than fuel for lorries

Fuel cell technology has been in use in intralogistics for a number of years, e.g., in forklifts. Linde has long been producing hydrogen-fuelled low lifting carts, haulers, and forklifts. One of their advantages over battery-operated vehicles is the short filling times.

How many filling stations are required?

The basis for good cargo transport with hydrogen vehicles is a comprehensive filling station network. The stations located throughout Europe are not sufficient, however. At least 140 stations are required in Germany to supply fuel cell lorries with hydrogen in 2027/2030, according to a study by the Fraunhofer Institute for System and Innovation Research (ISI). Thanks to a new investor, provider H2 Mobility wants to expand its presence in Germany to up to 300 stations, mainly for personal vehicles, by 2030 – while increasing the capacities of the individual locations five-fold. More possibilities for heavy vehicles are also expected. The stations must be accessible for lorries and buses at all locations.

Potential for other industries, too

Hydrogen is now being used in other mobility sectors, such as on a ferry in San Francisco. Trains are also testing fuel cell engines, while hydrogen-based fuels are being tested in air travel.